Plus500 Review

Plus500

- Covers diverse range of markets

- Offer the most trading instruments in the industry

- Leverage 1:30

Details

| Broker | Plus500 |

|---|---|

| Website URL | https://www.plus500.com |

| Founded | 2008 |

| Headquarters | Haifa |

| Support Types | FAQ , Email , Live chat |

| Languages | English , Arabic , Bahasa Melayu , Chinese , Dutch , French , German , Italian , Polish , Russian , Spanish. |

| Trading Platform | Webtrader | Mobile |

| Minimum 1st Deposit | $100 |

| Bonus | Plus500 does not offer bonuses, but their good reputation makes them highly recommendable. |

| Leverage | 1:30 |

| Spread | Variable |

| Free Demo Account |

|

| Regulated |

|

| Regulation | ASiC , CySEC , FCA |

| Account Types | Standard trading account , Demo account |

| Deposit Methods | Credit Card , Moneybookers , PayPal , Skrill , Wire transfer |

| Withdrawal Methods | Credit Card , Moneybookers , PayPal , Skrill , Wire transfer |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score |

Pros

- Well designed website

- Great trading platform

- Minimum deposit $100

Cons

- No telephone support

Plus500 review

Plus500 is one of world’s leading Contracts For Difference (CFDs) broker that was founded in 2008. The broker offers CFDs trading for different types of financial instruments such as Exchange Traded Funds (ETFs), Forex, commodities, stocks and market indices. Today, the Plus500 brand is operated by different subsidiaries of the Plus500 Ltd, headquartered in Israel and listed on the London Stock Exchange. The subsidiary companies operating the Plus500 brand name include Plus500 UK Ltd, Plus500 CY LTD and Plus500AU Pty Ltd.

The respective subsidiary companies are regulated at a local level where they are based. For example Plus500 UK Ltd is based in the UK and as such comes under the jurisdiction of the UK’s Financial Conduct Authority (FCA) under the registration FRN 509909. For Plus500 CY LTD which is based in Cyprus, the operations of the subsidiary company are regulated by the Cyprus Securities Exchange Commission (CySEC). For its Australian subsidiary Plus500AU Pty Ltd, Plus500 is regulated by the Australian Securities and Investments Commission (ASIC). With Plus500 strong financial backing, regulated status and user friendly website, trades at Plus500 can expect a rewarding trading experience.

Plus500 Types of Trading Accounts

For trading account types, Plus500 essentially has only 2 types of accounts, a standard trading account and a demo account. The demo account offered by Plus500 has no expiry date and allows you to fully access all the trading features on the Plus500 trading platform. Apart from letting you familiarize yourself with all the various aspects of the trading platform without any risk to yourself, the demo account also lets you practice and fine tune your trading strategies without having to risk real money. As for opening a standard trading account, you only need to fill out the registration form and place a minimum deposit of $100 before you can start trading live.

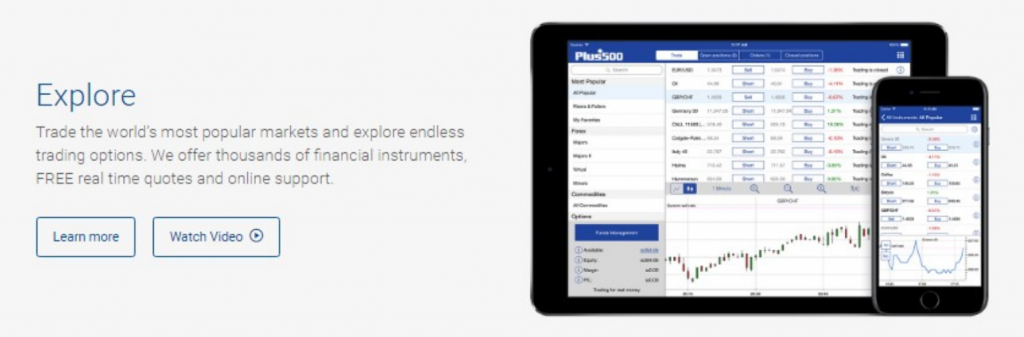

The trading platform adopted by Plus500 is a proprietary trading platform that is extremely versatile and efficient. The trading platform is user friendly and enables traders to execute their trades quickly without any hassles. Traders have 3 versions of the platform to choose from, a desktop version which requires you to download and install the software, a webtrader which can be accessed using any web browser and a mobile version which is available for download as an app.

With the dedicated CFDs trading platform, traders at Plus500 can trade different types of markets as such the currency market, the cryptocurrency markets, the ETFs market, the Stock Markets, the commodities market and the indices market. The selection of available instruments is also astronomical covering over 2000 different types of instruments. In addition, traders trading on the Plus500 trading platform can get to enjoy a leverage ratio of as high as 1:30.

Other interesting features of the Plus500 trading platform are the risk management tools integrated into the platform. The platform allows traders to manage the risk appetite according to ‘Total Position Value’ or ‘Equity’. Traders also have the option to set the levels where they want to exit from the market with market orders such as ‘Close at Profit’ or ‘Close at Loss’. With the “Trailing Stop” tool, you can also protect your trading profits. Finally, you can use the “Price Alert” tool to notify you when prices reach a specific level.

Plus500 Welcome offers

Due to the regulatory requirements imposed by regulatory authorities in UK and Cyprus, Plus500 does not offer any kind of welcome bonuses or offers.

Plus500 commissions and spreads

To compensate for its service offering, Plus500 charge its clients a slight spread on the Bid/Ask price that Plus500 receives from its liquidity providers. The spread is in fact incorporated into the quoted rates which traders essentially “pay” when they open a market position. There is no additional fee which Plus500’s traders have to pay when they make a trade on the Plus500 trading platform. As for the spreads paid by Plus500’s traders, they are not always dynamic and are constantly changing to reflect the conditions in the markets. Nevertheless, the overall spreads are pretty competitive with the benchmark EUR/USD spreads being dynamic and variable.

Apart from the spreads payable by traders when making a trade on the Plus500’s trading platform, there are other fees that they might incur when they trade on overnight positions, using a Guaranteed Stop Order to manage their trading risks or have not carried out any trading activities for three months. For overnight positions, traders might incur interests or have interests added to their trading accounts. With the Guaranteed Stop Order, the spreads are slightly wider due to the guarantee that it will be filled at your requested price.

Plus500 Deposits and Withdrawals

Plus500 offers 3 main types of payment methods. They include credit/debit cards, bank wire transfer and eWallets such as Paypal and Skrill. To deposit funds into your trading account, simply follow the following steps:

Step 1: Click on “Funds Management”

Step 2: Click on “Deposit”

Step 3: Select your deposit method for the list of options provided

Step 4: Fill in all the fields

Step 5: Click on “Submit”

Take note that each deposit method has a minimum deposit level. For withdrawals, the steps are similar except that for Step 2 where you select “Withdraw”. The timeframe required for a withdrawal to be completed depends on the methods used. Normally, the processing time is 3 to 7 business days although it can take as long as 10 business days depending on the region you are from.

You should also take note that Plus500’s policy on withdrawals is to make payments to the initial source of the deposited funds. Supposing you deposited funds into your trading account using your credit card, then the withdrawal method used by Plus500 to make payment will be through your credit card account. While Plus500 makes no mention of any withdrawal fees, it should be borne in mind that third party payment processors such as Skrill and Paypal do charge a fee for their services.

Finally before you can initiate any withdrawal request, you need to first verify your trading account as well as your payment method. Verification of payment method is to ensure that Plus500 is able to verify the legitimacy of the trader’s funds. To verify the payment method, you may be required to furnish a scan copy of your credit/debit card or a copy of your bank statement in the case of wire transfer.

Plus500 Customer Care and Support

Plus500 is one of the few leading CFD brokers around the world that is committed to providing their clients with great support. The support services are provided in dozens of different languages such as Arabic, Bahasa Melayu, Chinese, Dutch, French, German, Italian, Polish, Russian and Spanish. Nevertheless, it should be noted that the support is only available through a comprehensive FAQ section, live chat and email. Plus500 does not offer telephone support.

What we think of trading at Plus500?

Their website is well designed with minimal clutter and is user friendly. Plus500 is a very user-friendly platform, CFDs are “complex financial products”, thus the platform is not suitable for beginners/ un-experienced traders. However what makes Plus500 really stand from the crowd is the fact that the broker is able to cover a large and diverse range of markets. As mentioned earlier, you can choose from more than 2000 different types of instruments to trade with this broker.

The company currently offers its portfolio of over 2000 instruments. Furthermore, you also get to trade the markets with leverage as high as 1:30. However at the same time, we also noted that Plus500 is lacking in the customer support area. The methods of communicating with the support team is limited to just email FAQ section and live chat.

Visit Broker